All Categories

Featured

Table of Contents

On the various other hand, if a customer needs to offer an unique requirements youngster that may not be able to handle their own money, a depend on can be included as a recipient, enabling the trustee to manage the circulations. The kind of beneficiary an annuity owner chooses influences what the recipient can do with their inherited annuity and just how the profits will certainly be taxed.

Several agreements permit a spouse to determine what to do with the annuity after the owner dies. A spouse can transform the annuity agreement right into their name, assuming all guidelines and rights to the initial agreement and postponing instant tax effects (Fixed annuities). They can collect all remaining payments and any kind of death advantages and choose recipients

When a partner comes to be the annuitant, the partner takes over the stream of settlements. Joint and survivor annuities also enable a called beneficiary to take over the contract in a stream of settlements, rather than a swelling amount.

A non-spouse can just access the assigned funds from the annuity owner's preliminary agreement. In estate planning, a "non-designated recipient" refers to a non-person entity that can still be named a recipient. These include depends on, charities and various other companies. Annuity proprietors can pick to assign a trust as their beneficiary.

How do Retirement Annuities provide guaranteed income?

These distinctions designate which beneficiary will certainly receive the whole fatality benefit. If the annuity proprietor or annuitant passes away and the key beneficiary is still alive, the main recipient receives the survivor benefit. Nevertheless, if the main recipient predeceases the annuity owner or annuitant, the death advantage will certainly most likely to the contingent annuitant when the proprietor or annuitant passes away.

The owner can alter beneficiaries any time, as long as the agreement does not call for an irrevocable beneficiary to be named. According to experienced factor, Aamir M. Chalisa, "it is necessary to understand the significance of marking a recipient, as choosing the wrong recipient can have major repercussions. A number of our customers choose to call their underage youngsters as beneficiaries, often as the main beneficiaries in the lack of a partner.

Proprietors that are married must not presume their annuity instantly passes to their partner. Commonly, they experience probate initially. Our brief quiz supplies clarity on whether an annuity is a clever option for your retired life profile. When choosing a beneficiary, take into consideration factors such as your partnership with the individual, their age and how inheriting your annuity may affect their economic circumstance.

The recipient's partnership to the annuitant usually determines the regulations they comply with. For example, a spousal beneficiary has more alternatives for managing an inherited annuity and is treated even more leniently with taxation than a non-spouse beneficiary, such as a kid or various other family participant. Fixed-term annuities. Intend the proprietor does determine to name a child or grandchild as a recipient to their annuity

Who has the best customer service for Annuity Payout Options?

In estate preparation, a per stirpes classification specifies that, needs to your recipient pass away prior to you do, the recipient's offspring (children, grandchildren, et cetera) will obtain the survivor benefit. Attach with an annuity specialist. After you have actually selected and named your beneficiary or recipients, you should remain to evaluate your choices a minimum of as soon as a year.

Maintaining your classifications up to day can make certain that your annuity will certainly be managed according to your wishes ought to you pass away suddenly. A yearly testimonial, major life occasions can motivate annuity proprietors to take an additional look at their beneficiary choices.

How does an Lifetime Income Annuities help with retirement planning?

Similar to any kind of financial product, seeking the help of an economic expert can be useful. A financial planner can assist you through annuity administration processes, including the approaches for upgrading your contract's recipient. If no beneficiary is called, the payment of an annuity's fatality benefit goes to the estate of the annuity holder.

To make Wealthtender totally free for viewers, we make money from advertisers, including economic professionals and firms that pay to be featured. This produces a dispute of passion when we favor their promo over others. Read our editorial plan and regards to service to get more information. Wealthtender is not a customer of these economic services carriers.

As an author, it's one of the most effective compliments you can provide me. And though I really value any of you spending some of your busy days reviewing what I create, slapping for my write-up, and/or leaving praise in a remark, asking me to cover a subject for you genuinely makes my day.

It's you claiming you trust me to cover a topic that is necessary for you, which you're positive I 'd do so much better than what you can already discover online. Pretty stimulating stuff, and an obligation I do not take most likely. If I'm not accustomed to the subject, I investigate it online and/or with contacts who know even more about it than I do.

What does an Flexible Premium Annuities include?

Are annuities a legitimate referral, an intelligent step to safeguard guaranteed earnings for life? In the simplest terms, an annuity is an insurance policy product (that just licensed agents may sell) that ensures you month-to-month settlements.

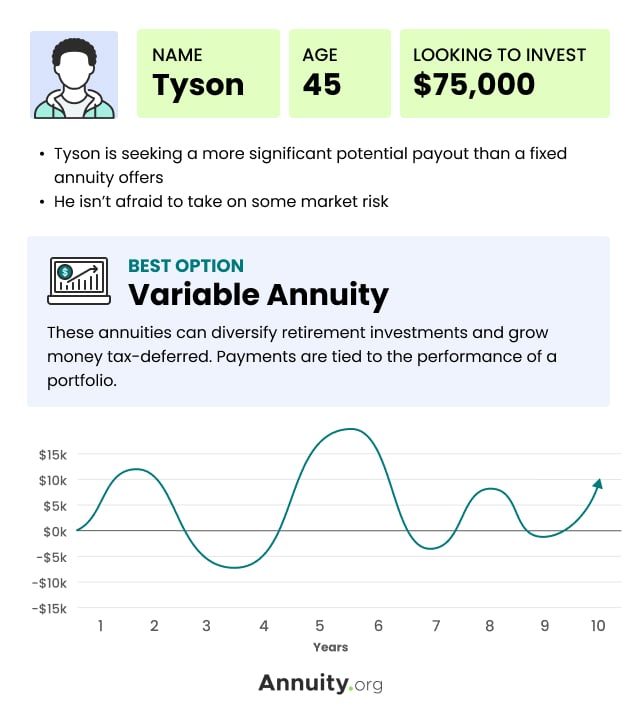

This generally uses to variable annuities. The even more bikers you tack on, and the much less risk you're eager to take, the reduced the payments you ought to expect to receive for a given costs.

Can I get an Retirement Income From Annuities online?

Annuities picked correctly are the appropriate choice for some people in some conditions., and after that figure out if any kind of annuity alternative supplies enough advantages to justify the costs. I made use of the calculator on 5/26/2022 to see what an immediate annuity might payment for a single costs of $100,000 when the insured and partner are both 60 and live in Maryland.

Latest Posts

Who offers flexible Variable Annuities policies?

Long-term Care Annuities

What is the difference between an Lifetime Payout Annuities and other retirement accounts?